Introduction to the Invoice Management System

The new **Invoice Management System (IMS)** allows taxpayers to efficiently address invoice corrections and amendments with their suppliers via the GST portal. This system helps ensure correct Input Tax Credit (ITC) and provides a new communication process for taxpayers to accept, reject, or keep an invoice pending in the system.

This functionality will be available to taxpayers starting **1st October**, and it will become an integral part of the **ITC ecosystem** under the GST regime.

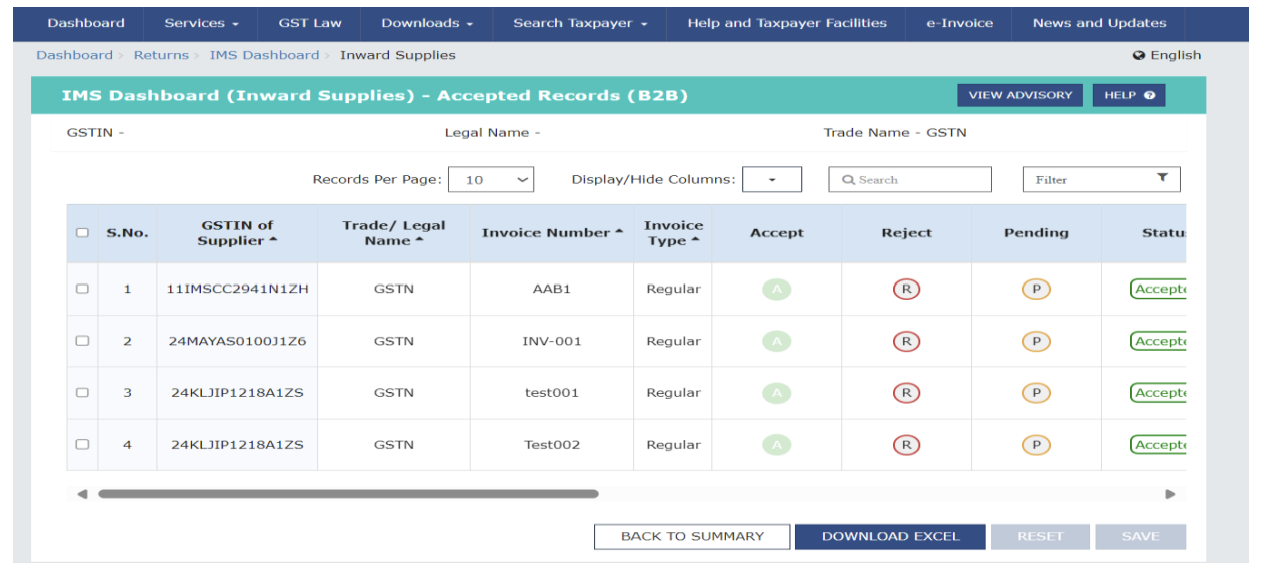

Sample IMS Dashboard

How IMS Works

Once a supplier saves an invoice in **GSTR-1** or **IFF**, the invoice will be reflected in the IMS dashboard of the recipient taxpayer. From here, the recipient can take one of the following actions:

- Accept: The invoice will be considered for the GSTR-2B generation and auto-populated in GSTR-3B.

- Reject: The invoice will not be considered for GSTR-2B generation.

- Pending: The invoice will not be considered for GSTR-2B for that month but can be processed later.

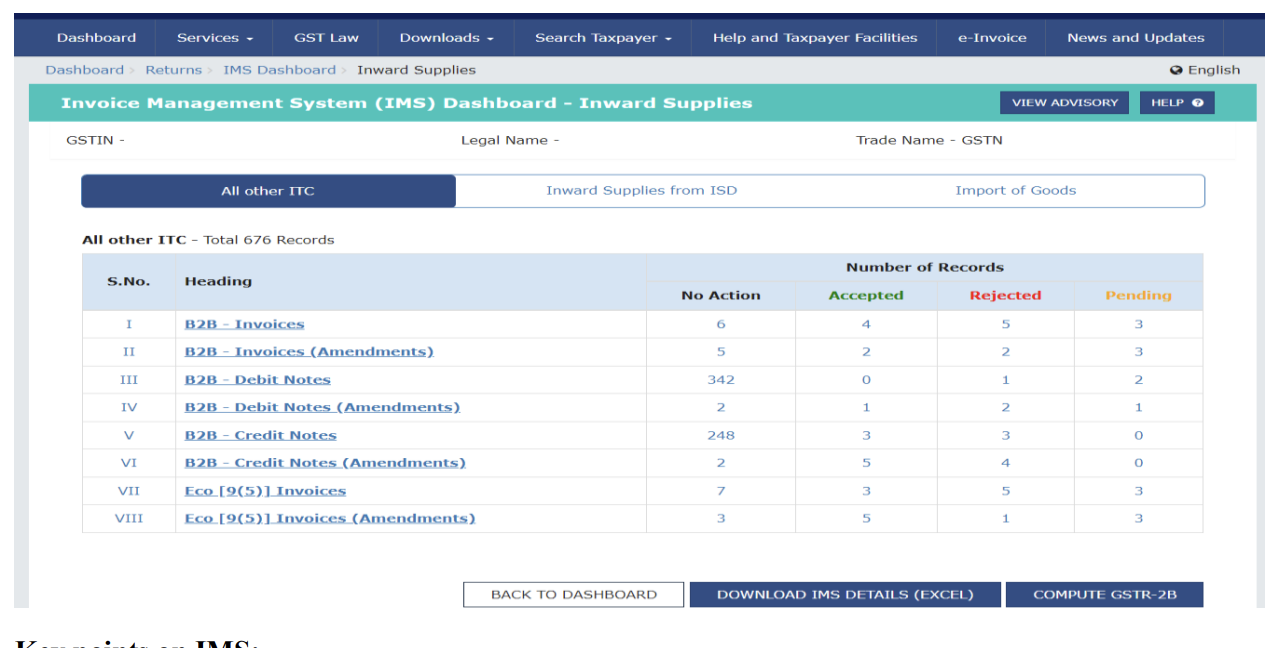

Key Functionality in IMS

- Accepted invoices will move to **GSTR-2B** as eligible ITC.

- Invoices marked as **Pending** will remain in the dashboard for further action in the future.

- Rejected invoices will not form part of the ITC calculation in GSTR-2B.

IMS Functionality Overview

QRMP Taxpayers

For **Quarterly Return Monthly Payment (QRMP)** taxpayers, invoices filed through the **IFF** will flow to the IMS, and GSTR-2B will be generated quarterly. It's important to note that **GSTR-2B** will not be generated for months **M-1** and **M-2** for QRMP taxpayers.

Key IMS Features

- Records will be deemed accepted if no action is taken by the taxpayer before **GSTR-2B** generation.

- Amendments made by suppliers in **GSTR-1A** will also flow into the IMS for recipient taxpayers.

- Pending records will stay in the IMS dashboard until further action is taken.