Latest Blog Posts

Stay updated with the latest trends, insights, and news from the world of finance and consulting.

The Importance of Cash Flow Management

Learn why managing your cash flow effectively is crucial for the financial health of your business and how a Virtual CFO can help.

Read More

Royalty Payments Under the India-UK DTAA

Explore the taxability of royalty payments made by an Indian entity to a UK-based company, with a focus on the provisions under the India-UK Double Taxation Avoidance Agreement (DTAA).

Read More

Embracing AI in Financial and Compliance Services

The integration of Artificial Intelligence (AI) into financial services is rapidly transforming the way Chartered Accountants and financial professionals.

Read More

Automated GSTR-2A Data Conversion

Process B2B and CDNR data efficiently, reducing manual work and errors.

Read More

Tally-Compatible XML Generation

Seamlessly convert Excel files into Tally-compatible XML format..

Read More

AI-Driven Compliance Management

AI simplifies compliance management by continuously monitoring regulatory changes and updating protocols. Learn how our AI tools keep your business compliant.

Read More

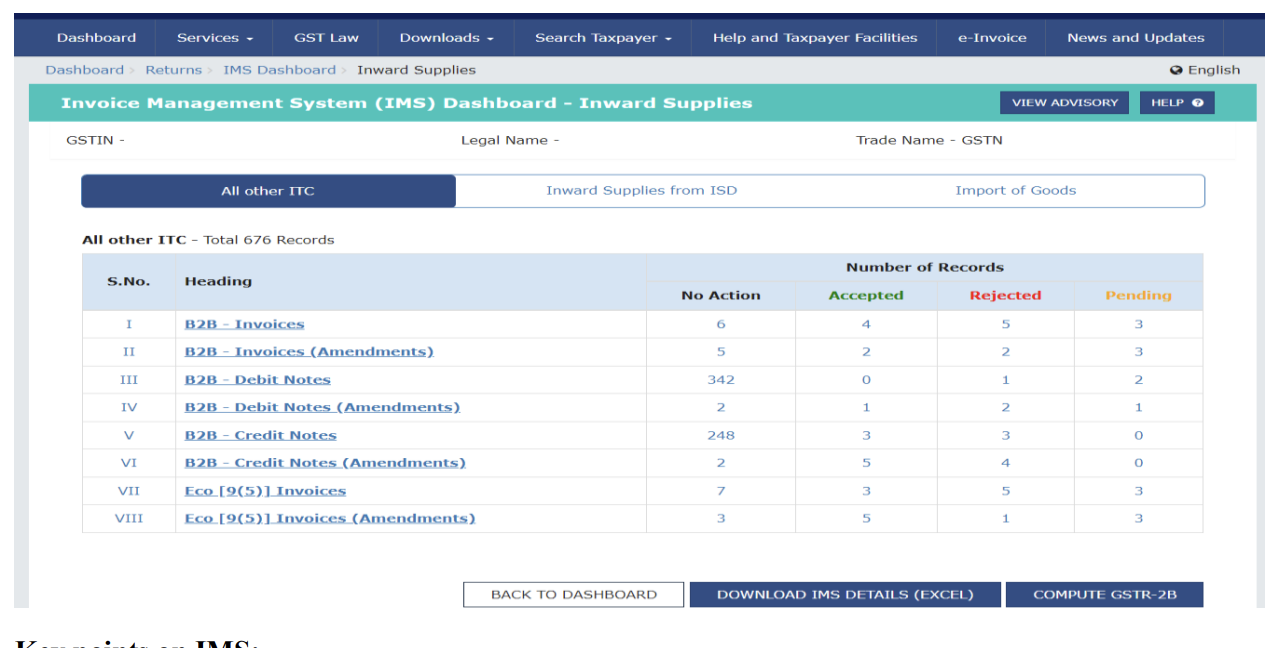

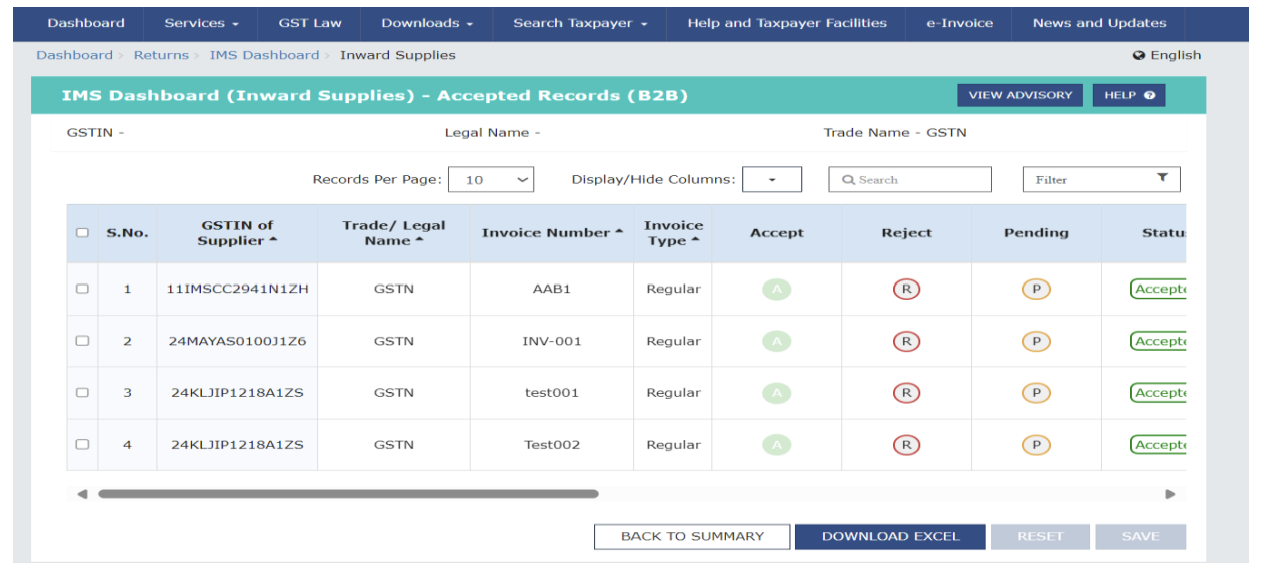

Invoice Management System (IMS)

The new Invoice Management System allows taxpayers to efficiently address invoice corrections and amendments with their suppliers via the GST portal. This system helps ensure correct Input Tax Credit (ITC) and provides a new communication process for taxpayers to accept, reject, or keep an invoice pending in the system.

Read More

Key Recommendations from the 54th GST Council Meeting

The GST Council met under the Chairpersonship of Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman. Below are the key decisions made during the meeting.

Read More

GST Advisory for GTA Services

Comprehensive Guidance on Taxation, Input Tax Credit (ITC), and Compliance for GTA Businesses.

Read More

M/s Safari Retreats Private Ltd. and Section 17(5)(d) of the CGST Act

The case of M/s Safari Retreats Private Ltd. vs. the Chief Commissioner of Central Goods and Services Tax (GST) is a significant landmark in the GST legal landscape. It raises crucial questions on the applicability of Input Tax Credit (ITC) under Section 17(5)(d) of the Central Goods and Services Tax Act (CGST Act), 2017, specifically for businesses involved in renting out immovable property.

Read More

Comprehensive Guidelines on Waiver of Interest and Penalty under

The Government of India, through the Central Board of Indirect Taxes and Customs (CBIC), issued Circular No. 238/32/2024-GST on 15th October 2024. This circular provides clarifications regarding Section 128A of the Central Goods and Services Tax (CGST) Act, 2017, effective from 1st November 2024. These clarifications aim to guide taxpayers on the waiver of interest and penalty, or both, under specific circumstances for tax demands related to financial years 2017-18, 2018-19, and 2019-20

Read More

GST Implications for Goods Transport Agencies (GTAs)

transactions between two GTAs or between a GTA and its clients often require careful analysis to ensure GST compliance

Read More

GST Compliance for Government Entities in India

Goods and Services Tax (GST) in India, the tax obligations for government entities became more structured and aligned with those of private organizations

Read More

TDS on Metal Scrap under GST

In an effort to streamline tax compliance within the metal scrap industry, the Indian government has introduced new TDS provisions specific to metal scrap transactions

Read More

New Requirements for Filing of Annual RODTEP Return (ARR)

The DGFT has introduced new guidelines under Paragraph 4.94 in Chapter 4 of the Handbook of Procedures, 2023. These updates, effective as of October 2023, provide detailed requirements for exporters who benefit from the RODTEP scheme, mandating the filing of an Annual RODTEP Return (ARR)

Read More

GST Applicability on Donations and Contributions for Associations Providing Representational Services

When an Association of Persons (AOP) or a similar organization receives funds, it’s essential to analyze if these receipts fall within the scope of "supply" under GST.

Read More

An In-Depth Guide to Filing GSTR-9 and GSTR-9C for FY 2023-24

The Goods and Services Tax (GST) regime in India requires annual filing of GSTR-9 and GSTR-9C, which serve as crucial documents for summarizing a taxpayer's yearly transactions and reconciling them with previously filed returns. In this guide, we’ll explore the purpose, structure, requirements, and detailed steps for filing these returns, focusing on changes and updates for the Financial Year 2023-24.

Read More

Comprehensive Guide to Corporate Taxation in India

Corporate taxation in India forms the backbone of the government’s revenue system and significantly influences business decisions. Governed by the Income Tax Act, 1961, it applies to domestic and foreign companies, with different rates and incentives depending on the company's type, size, and structure.

Read More

Understanding DRC Forms under GST

DRC (Dispute Resolution and Compliance) forms are a set of forms used under the Goods and Services Tax (GST) regime in India. These forms facilitate communication, compliance, and resolution of disputes between taxpayers and GST authorities.

Read More

Overview of GST PMT Series Forms

A comprehensive guide to managing GST payments, credits, and liabilities.

Read More

Understanding GSTR-1A: Objectives, Purpose, and Process

GSTR-1A is a supplementary GST return form designed to help taxpayers amend or add details to their previously filed GSTR-1 for the same tax period. This ensures that all outward supply details are accurately captured before finalizing the tax liability in GSTR-3B.

Read More

Comprehensive Guide to Input Tax Credit (ITC) and Reverse Charge Mechanism (RCM) under GST

Normal ITC refers to the credit claimed by a registered taxpayer for the GST paid on inward supplies (goods or services) against the GST liability.

Read More

Key Areas Where AI Benefits Chartered Accountants

The Role of AI in Transforming the Work of Chartered Accountants in India.

Read More

Admission of New Partners and Liability for Existing Obligations

Legal Framework Under the Indian Partnership Act, 1932.

Read More

Recommendations of the 55th Meeting of the GST Council

Recommendations of the 55th Meeting of the GST Council

Read More