54th GST Council Meeting Highlights

Everything You Need to Know About the Latest Recommendations

Key Recommendations from the 54th GST Council Meeting

The GST Council met under the Chairpersonship of Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman. Below are the key decisions made during the meeting:

1. Changes in GST Tax Rates

Namkeens and Extruded/Expanded Savoury Food Products: The GST rate has been reduced from 18% to 12% for savoury or salted extruded products.

Cancer Drugs: GST on cancer drugs like Trastuzumab Deruxtecan, Osimertinib, and Durvalumab has been reduced from 12% to 5%.

Metal Scrap: Reverse Charge Mechanism (RCM) to be introduced on the supply of metal scrap by unregistered persons to registered persons.

2. Services

Life and Health Insurance: A Group of Ministers (GoM) will examine GST-related issues on life and health insurance.

Flying Training Courses: GST-exempt status for approved flying training courses conducted by DGCA-approved Flying Training Organizations.

3. Measures for Facilitation of Trade

Waiver of Penalties: Penalties under section 73 of the CGST Act will be waived for financial years 2017-18 to 2019-20, with specific guidelines issued.

| Scenario | Tax Rate | Effective Date |

|---|---|---|

| Namkeens and Extruded/Expanded Savoury Food Products | 12% (Previously 18%) | 1st October 2024 |

| Cancer Drugs | 5% (Previously 12%) | 1st October 2024 |

| Metal Scrap (RCM) | 2% TDS on B2B supply | Effective from notification date |

4. New Ledgers and Invoice Management System (IMS)

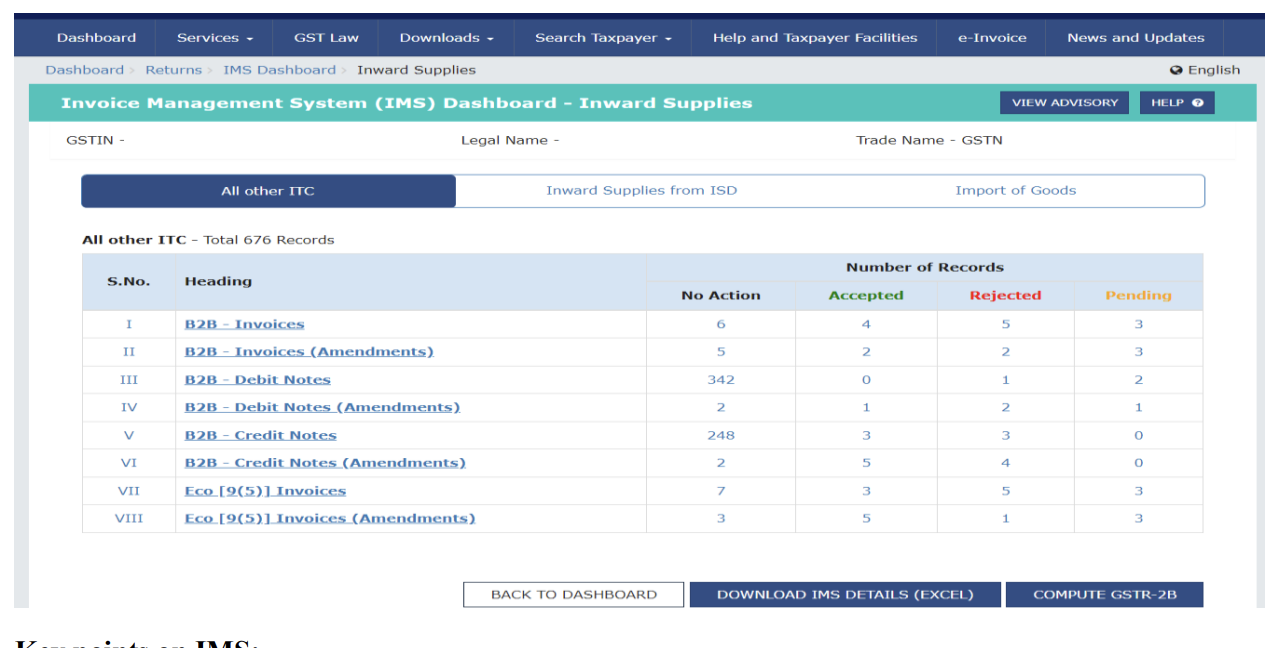

IMS will allow taxpayers to accept, reject, or keep invoices pending for the purpose of claiming Input Tax Credit (ITC). The system is aimed at reducing errors in ITC claims and improving reconciliation.

Illustration of the IMS Dashboard for managing input tax credits.

Frequently Asked Questions (FAQ)

What is the new GST rate for Cancer Drugs?

The GST rate for certain cancer drugs such as Trastuzumab Deruxtecan and Osimertinib has been reduced from 12% to 5%.

What are the key changes for Namkeens and Extruded Products?

The GST rate for savoury or salted extruded/expanded products has been reduced from 18% to 12%, aligning with other similar products like namkeens and bhujia.

What is the Invoice Management System (IMS)?

The IMS is a new feature that allows taxpayers to review, accept, reject, or keep invoices pending before claiming input tax credit (ITC). This will help reduce errors and improve reconciliation.